Table of Contents

What Are The Accounting Assumptions?

Accounting assumptions establish the framework for disclosing financial transactions in the financial statements. They serve as guidelines mandating companies to conduct their business operations and reporting in accordance with standards set by the FASB. The purpose of these assumptions is to establish a foundation of consistency, allowing financial statement readers to assess the accuracy of a company’s financials and affirm its depicted financial health.

Integral to the organizational well-being, these assumptions dictate how financial transactions are to be reported in the financial statements, compelling companies to adhere comprehensively to statutory requirements. Emphasizing the reliability, authenticity, and credibility of an organization’s financial statements, these assumptions prove valuable for the company itself, its management, and those interpreting the financial statements.

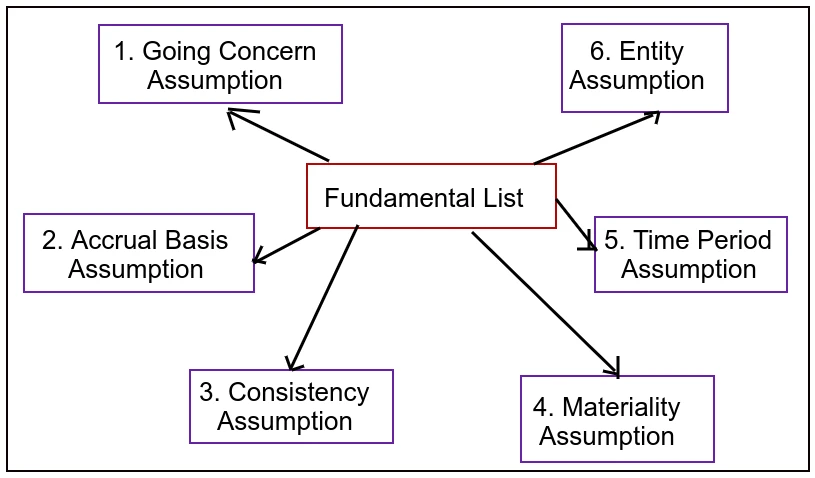

Fundamental List

Accounting assumptions are foundational principles that shape the framework of accounting practices, providing a set of guiding principles for the recording and presentation of financial information. These assumptions are fundamental to the accuracy, consistency, and reliability of financial reporting. Here are key accounting assumptions that underpin the discipline:

1. Going Concern Assumption:

This assumption assumes that a business will continue to operate indefinitely. It implies that the entity will not be forced to liquidate or cease operations in the foreseeable future. The going concern assumption forms the basis for valuing assets and liabilities and preparing financial statements.

2. Accrual Basis Assumption:

The accrual basis assumption requires that transactions be recorded in the accounting period in which they occur, regardless of when the cash is exchanged. This approach provides a more accurate representation of a company’s financial position and performance over time.

3. Consistency Assumption:

The consistency assumption states that once an accounting method or principle is chosen, it should be consistently applied from one period to another. Consistency enhances comparability, allowing users of financial statements to analyze trends and make informed decisions.

4. Materiality Assumption:

The materiality assumption holds that financial statements should include information significant enough to influence the decisions of users. Immaterial items, if included, could potentially distort the overall picture without adding significant value.

5. Time Period Assumption:

The time period assumption assumes that the economic activity of an entity can be divided into distinct and regular time periods for financial reporting purposes. This division facilitates the preparation of interim financial statements and allows users to assess performance over specific timeframes.

6. Entity Assumption:

The entity assumption treats the business as a separate and distinct economic entity from its owners or other businesses. This separation is essential for accurately measuring the financial position and performance of the entity.

7. Monetary Unit Assumption:

The monetary unit assumption assumes that financial transactions are recorded in a common monetary unit, such as the currency of the country where the entity operates. This assumption facilitates the measurement and comparison of financial information.

These accounting assumptions collectively provide a conceptual foundation for the accounting profession, guiding practitioners in the consistent and reliable preparation of financial statements. Adherence to these assumptions helps ensure that financial information is presented accurately, enhancing the usefulness of financial statements for decision-making purposes.

Examples of Accounting Assumptions

Example 1

ABC Company assumes that it will continue its business operations for the foreseeable future without the need for liquidation.

Example 2

XYZ Corporation records revenue when it is earned, not necessarily when the cash is received, ensuring a more accurate representation of financial activities.

Example 3

LMN Inc. consistently applies the same depreciation method each year, promoting comparability in financial statements over different periods.

Example 4

Company PQR excludes immaterial transactions from its financial statements to avoid clutter and focus on significant information influencing decisions.

Example 5

DEF Ltd. divides its financial reporting into quarterly periods, allowing stakeholders to analyze the company’s performance over specific timeframes.

Example 6

MNO Corporation treats its business as a separate entity from its owners, ensuring accurate measurement of financial position and performance.

Benefits of Accounting Assumptions

The benefits of accounting assumptions are significant and contribute to the reliability and consistency of financial reporting. Here are some key advantages:

- Consistency in Reporting

- Accounting assumptions, such as the consistency assumption, promote uniformity in financial reporting. This consistency allows stakeholders to compare financial statements across different periods, facilitating a better understanding of an organization’s performance trends.

- Accurate Financial Representation

- The accrual basis assumption ensures that financial transactions are recorded when they occur, providing a more accurate representation of an organization’s financial position and performance. This contributes to a clearer picture of the economic realities within a given accounting period.

- Enhanced Decision-Making:

- Accounting assumptions help create a reliable foundation for financial statements, aiding decision-makers in making informed choices. With accurate and consistent financial information, management, investors, and other stakeholders can assess a company’s financial health and strategize accordingly.

- Investor Confidence

- Adherence to accounting assumptions, particularly the going concern assumption, instills confidence in investors and creditors. Knowing that financial statements are prepared with the assumption that the business will continue operating provides assurance about the company’s stability and future prospects.

- Comparability Across Entities

- Accounting assumptions, such as the entity assumption, ensure that financial information is specific to the reporting entity. This promotes comparability, allowing stakeholders to evaluate the financial performance of different entities using standardized principles.

- Transparent Financial Reporting

- Materiality and disclosure-related assumptions contribute to transparent financial reporting. By focusing on material information and disclosing relevant details, financial statements become more understandable and trustworthy for users.

- Simplified Measurement

- The monetary unit assumption simplifies the measurement of financial transactions by recording them in a common monetary unit. This simplification facilitates straightforward comparisons and analyses.