Table of Contents

What Is the Intrinsic Value of a Stock?

The intrinsic value of a stock represents its true worth based on fundamental analysis and the company’s underlying financial performance. It’s a theoretical concept that attempts to quantify what a stock is really worth, regardless of its current market price. In essence, it reflects the present value of all future cash flows that an investor expects to receive from owning the stock.

Determining the intrinsic value of a stock involves various valuation methods, each with its own set of assumptions and inputs. Some common methods include:

- Discounted Cash Flow (DCF) Analysis

- Dividend Discount Model (DDM)

- Earnings-Based Models

- Asset-Based Valuation

It’s important to note that intrinsic value is a theoretical concept and may vary depending on the assumptions and inputs used in the valuation model. Additionally, market prices may deviate from intrinsic value due to factors such as market sentiment, speculation, and irrational behavior.

Despite its theoretical nature, intrinsic value serves as a valuable tool for investors, helping them make informed decisions about buying, selling, or holding stocks based on their assessment of a company’s true worth. By focusing on fundamental factors rather than short-term market fluctuations, investors can navigate the stock market with a long-term perspective, seeking to capitalize on opportunities that align with their investment goals and risk tolerance.

Dividend Discount Models

Dividend Discount Models (DDMs) are valuation techniques used by investors to estimate the intrinsic value of a stock based on its expected future dividend payments. The underlying assumption of DDMs is that the present value of all future dividends represents the intrinsic worth of the stock.

There are two main types of dividend discount models:

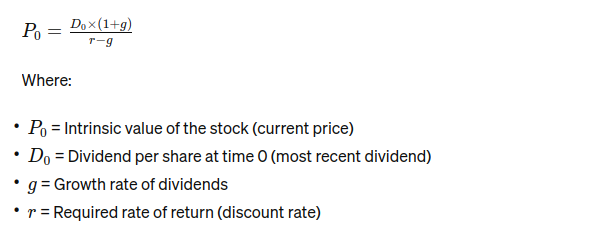

- Gordon Growth Model: Also known as the Dividend Discount Model (DDM) with Constant Growth, this model assumes that dividends will grow at a constant rate indefinitely. The formula for the Gordon Growth Model is:

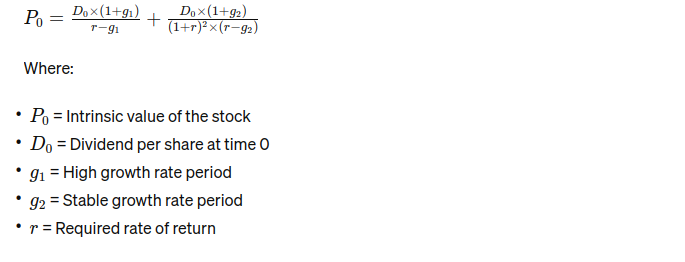

- Two-Stage Dividend Discount Model: This model accommodates companies with different growth phases by assuming a high growth rate for an initial period followed by a lower, more stable growth rate. The formula for the Two-Stage Dividend Discount Model is:

Residual Income Models

The Residual Income Model (RIM) is an alternative approach to valuing a stock that focuses on the equity of a company. Here’s the formula expressed in MathJax code:

\(\text{Residual Income (RI)}\) = \( \text{Net Income}\) – \( (\text{Equity} \times \text{Cost of Equity})\)

Where:

- \(\text{Net Income}\) represents the company’s net income.

- \(\text{Equity}\) is the book value of the company’s equity.

- \(\text{Cost of Equity}\) is the required rate of return on equity capital.

Discounted Cash Flow Models

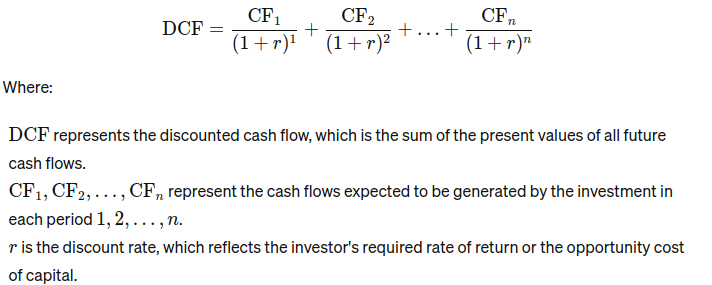

The Discounted Cash Flow (DCF) model is a valuation method used to estimate the intrinsic value of a stock by discounting its future cash flows to their present value. Here’s the formula expressed in MathJax code:

FAQs

-

What is intrinsic value in stock market terms?

Intrinsic value refers to the true worth of a stock based on its fundamental characteristics and future cash flow potential. It represents what the stock is really worth regardless of its current market price.

-

How is intrinsic value calculated?

Intrinsic value can be calculated using various methods, including Discounted Cash Flow (DCF) analysis, Dividend Discount Models (DDM), Residual Income Models (RIM), and earnings-based approaches. These methods involve estimating future cash flows or dividends and discounting them back to their present value.

-

Why is understanding intrinsic value important for investors?

Understanding intrinsic value is crucial for investors as it provides insights into whether a stock is undervalued, overvalued, or fairly priced. It helps investors make informed decisions about buying, selling, or holding stocks based on their assessment of a company’s true worth.

-

Can intrinsic value change over time?

Yes, intrinsic value can change over time as new information becomes available, economic conditions evolve, and the company’s fundamentals change. Investors need to regularly reassess intrinsic value to account for these factors and adjust their investment decisions accordingly.

-

Does the market price always equal intrinsic value?

No, the market price of a stock may not always equal its intrinsic value. Market prices are influenced by factors such as investor sentiment, speculation, and market dynamics, which can cause prices to deviate from intrinsic value in the short term. However, over the long term, market prices tend to converge towards intrinsic value.

-

How can investors use intrinsic value in their investment strategy?

Investors can use intrinsic value as a guide to identify opportunities in the stock market. By focusing on companies with intrinsic values higher than their market prices, investors can potentially uncover undervalued stocks with strong growth potential. Conversely, they can avoid overpaying for stocks trading above their intrinsic value.