Table of Contents

What Are Accounting Reports?

Accounting reports are comprehensive documents that summarize an organization’s financial transactions, performance, and position over a specific period. These reports provide stakeholders, including management, investors, and regulators, with essential insights into the financial health and performance of a business. Accounting reports are crucial for decision-making, financial analysis, and ensuring transparency.

Why Do You Need Accounting Reports?

Accounting reports are essential for several reasons:

- Decision-Making: Management relies on accounting reports to make informed decisions about resource allocation, investments, and strategic planning.

- Investor Confidence: Shareholders and investors use accounting reports to assess the financial stability and profitability of a company, influencing investment decisions.

- Regulatory Compliance: Accounting reports are often required by regulatory authorities to ensure compliance with financial reporting standards and legal requirements.

- Performance Evaluation: Businesses use accounting reports to evaluate their financial performance, identifying strengths and areas for improvement.

Types Of Accounting Reports

Accounting reports are essential tools that provide insights into a company’s financial health and performance. These reports help stakeholders, including management, investors, and regulatory authorities, make informed decisions and assess the organization’s overall financial position. Here’s a detailed exploration of various types of accounting reports:

1. Income Statement (Profit and Loss Statement):

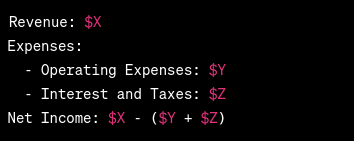

The Income Statement, also known as the Profit and Loss (P&L) Statement, provides a summary of an organization’s revenues, expenses, and profits or losses over a specific period. It outlines the financial performance by showing how much money the company earned (revenues) and how much it spent (expenses) to generate a net profit or loss.

Components of an Income Statement:

-

- Revenues: The total amount of money generated from the sale of goods or services.

- Expenses: The costs incurred to operate the business, including operating expenses, interest, and taxes.

- Net Income (or Net Loss): The difference between total revenues and total expenses.

2. Balance Sheet (Statement of Financial Position)

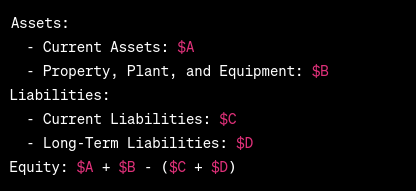

The Balance Sheet provides a snapshot of a company’s financial position at a specific point in time, typically at the end of an accounting period. It presents the organization’s assets, liabilities, and equity, giving a comprehensive view of its financial health.

Components of a Balance Sheet:

-

- Assets: The resources owned by the company, including current assets (e.g., cash, receivables) and non-current assets (e.g., property, equipment).

- Liabilities: The company’s obligations, categorized as current liabilities (e.g., short-term debt) and non-current liabilities (e.g., long-term debt).

- Equity: The residual interest in the assets of the company after deducting liabilities. It includes common stock, retained earnings, and additional paid-in capital.

3. Cash Flow Statement

The Cash Flow Statement provides a detailed account of how cash and cash equivalents move in and out of a business during a specific period. It is divided into three main categories: operating activities, investing activities, and financing activities.

Components of a Cash Flow Statement:

-

- Operating Activities: Cash transactions related to the core business operations, such as receipts from customers and payments to suppliers.

- Investing Activities: Cash transactions for buying and selling long-term assets, including property, equipment, and investments.

- Financing Activities: Cash transactions with the company’s owners and creditors, including issuing or repurchasing stock and borrowing or repaying debt.

4. Statement of Changes in Equity

The Statement of Changes in Equity illustrates the changes in equity accounts over a specific period. It provides details about the transactions affecting equity, including changes in common stock, retained earnings, and additional paid-in capital.

Components of a Statement of Changes in Equity:

-

- Common Stock: The total value of shares issued by the company.

- Retained Earnings: Accumulated profits or losses from previous periods.

- Additional Paid-In Capital: The excess amount received from the issuance of stock over its par value.

5. Financial Ratios and Analysis Reports

Financial ratios and analysis reports involve the use of various ratios to assess a company’s financial performance and position. These ratios provide valuable insights into liquidity, profitability, solvency, and efficiency.

Key Financial Ratios:

-

- Liquidity Ratios: Measure a company’s ability to meet short-term obligations (e.g., Current Ratio, Quick Ratio).

- Profitability Ratios: Evaluate the company’s ability to generate profits (e.g., Return on Equity, Gross Margin).

- Solvency Ratios: Assess a company’s long-term financial viability (e.g., Debt-to-Equity Ratio).

- Efficiency Ratios: Gauge how effectively a company utilizes its assets (e.g., Inventory Turnover, Accounts Receivable Turnover).

6. Budgetary Reports

Budgetary reports compare actual financial performance with the budgeted or planned figures. These reports help management assess how well the company is adhering to its financial plans and identify areas that require attention or adjustment.

Components of Budgetary Reports:

-

- Actual vs. Budgeted Revenue: A comparison of actual revenue with the budgeted amount.

- Actual vs. Budgeted Expenses: A comparison of actual expenses with the budgeted amount.

- Variance Analysis: Evaluation of the differences (variances) between actual and budgeted figures.

7. Audit Reports

Audit reports are prepared by external auditors who review and validate a company’s financial statements. These reports provide an independent assessment of the fairness and accuracy of the financial information presented by the organization.

Key Components of an Audit Report:

-

- Opinion: The auditor’s professional judgment on whether the financial statements are presented fairly in accordance with applicable accounting standards.

- Scope: A description of the extent of the audit procedures performed and any limitations encountered during the audit.

- Findings: Any significant issues or exceptions identified during the audit process.

8. Management Discussion and Analysis (MD&A)

The MD&A is a narrative section accompanying the financial statements, written by the company’s management. It provides an overview of the company’s financial performance, discusses significant events, and offers insights into future plans and strategies.

Components of MD&A:

-

- Financial Overview: A summary of the financial results and key performance indicators.

- Liquidity and Capital Resources: Discussion on how the company manages its cash flow and capital structure.

- Risk Factors: Identification and assessment of potential risks affecting the company’s financial well-being.

Accounting Reports Examples

Examples of accounting reports include:

Income Statement Example:

Balance Sheet Example:

Accounting KPIs Examples

Key Performance Indicators (KPIs) in accounting include:

- Return on Investment (ROI): Measures the profitability of an investment relative to its cost.

- Debt-to-Equity Ratio: Assesses a company’s financial leverage by comparing its debt to equity.

- Current Ratio: Evaluates a company’s ability to cover short-term liabilities with its short-term assets.

- Gross Margin: Calculates the percentage of revenue remaining after deducting the cost of goods sold.

How To Create Accounting Reports

Creating accounting reports involves a systematic process to ensure accuracy, completeness, and compliance with accounting standards. Here is a step-by-step guide on how to create accounting reports:

-

Gather Financial Data:

- Collect all relevant financial data for the reporting period. This includes transaction records, bank statements, invoices, receipts, and other financial documents.

-

Organize and Classify Transactions:

- Categorize transactions into appropriate accounts based on the chart of accounts. Common accounts include revenue, expenses, assets, liabilities, and equity. Ensure consistency in account classification.

-

Use Accounting Software:

- Leverage accounting software to streamline the reporting process. Accounting software automates data entry, calculations, and report generation, reducing the risk of errors and saving time.

-

Prepare the Trial Balance:

- Generate a trial balance to ensure that debits and credits in the accounting system are equal. This step helps identify any discrepancies that need correction before preparing financial statements.

-

Create Financial Statements:

- Generate the core financial statements: Income Statement, Balance Sheet, and Cash Flow Statement. These statements provide a comprehensive view of the company’s financial performance, position, and cash flow.

- Income Statement (Profit and Loss Statement):

- Summarizes revenues, expenses, and net income or loss over a specific period.

- Balance Sheet (Statement of Financial Position):

- Presents assets, liabilities, and equity at a specific point in time.

- Cash Flow Statement:

- Details the inflow and outflow of cash and cash equivalents.

- Income Statement (Profit and Loss Statement):

- Generate the core financial statements: Income Statement, Balance Sheet, and Cash Flow Statement. These statements provide a comprehensive view of the company’s financial performance, position, and cash flow.

-

Include Supporting Schedules:

- Depending on the complexity of the financial reporting, include supporting schedules and disclosures. This may involve detailing specific accounts, providing explanations, and including additional information for transparency.

-

Budgetary Reports (If Applicable):

- If budgetary reports are part of the reporting process, compare actual financial performance with the budgeted figures. Highlight variances and analyze the reasons for any discrepancies.

-

Generate Financial Ratios:

- Calculate and include key financial ratios relevant to your industry. Common ratios include profitability ratios, liquidity ratios, solvency ratios, and efficiency ratios. These ratios offer additional insights into the financial health of the business.

-

Management Discussion and Analysis (MD&A):

- If required, prepare a Management Discussion and Analysis section. This narrative report provides an overview of the company’s financial results, significant events, and future plans. It adds context to the numbers presented in the financial statements.

-

Audit and Review (If Applicable):

- If the financial statements are subject to external audit or review, coordinate with auditors or reviewers. Provide them with the necessary documentation and address any queries or concerns.

-

Finalize and Distribute:

- Finalize the accounting reports after addressing any identified issues or adjustments. Distribute the reports to relevant stakeholders, including management, investors, creditors, and regulatory authorities.

-

File Regulatory Reports (If Required):

- Ensure compliance with regulatory requirements by filing necessary reports with relevant authorities. This may include tax filings, submissions to regulatory bodies, or other industry-specific reporting obligations.

-

Document the Process:

- Maintain documentation of the entire reporting process, including assumptions, methodologies, and any significant accounting policies applied. This documentation is crucial for transparency and can support future audits or reviews.

-

Continuous Improvement:

- After completing the reporting cycle, conduct a review to identify areas for improvement. Assess the efficiency of the reporting process, the accuracy of data, and the effectiveness of internal controls. Implement changes as needed for future reporting cycles.

-

Training and Communication:

- Ensure that relevant staff members are trained on the reporting process and any changes in accounting standards. Effective communication within the finance team and with other departments is crucial for a smooth reporting process.

Who benefits from accounting reporting?

Accounting reporting benefits a wide range of stakeholders, providing them with valuable information about a company’s financial health, performance, and overall position. The primary beneficiaries include:

-

Management and Internal Stakeholders:

- Strategic Decision-Making: Management relies on accounting reports to make informed strategic decisions. Financial statements and reports help in assessing the profitability of products or services, determining cost-effective strategies, and allocating resources efficiently.

- Performance Evaluation: Internal stakeholders, including executives and managers, use accounting reports to evaluate the company’s operational performance. Key performance indicators (KPIs) and financial ratios assist in identifying areas for improvement and setting performance benchmarks.

- Budgeting and Planning: Accounting reports, especially budgetary reports, aid in the budgeting and planning process. They provide a basis for setting financial goals, allocating resources, and tracking actual performance against planned figures.

-

Investors and Shareholders:

- Investment Decisions: Investors and shareholders rely on accounting reports to assess the financial health of a company before making investment decisions. These reports provide insights into the company’s profitability, liquidity, and overall stability.

- Dividend Decisions: Shareholders use accounting information to evaluate the company’s ability to generate profits and pay dividends. A company’s dividend history and financial performance are crucial factors influencing investor decisions.

-

Creditors and Lenders:

- Credit Risk Assessment: Creditors and lenders, such as banks and financial institutions, use accounting reports to assess the creditworthiness of a company. The reports help in evaluating the company’s ability to meet its financial obligations and repay loans.

- Terms of Credit: Accounting information assists creditors in determining the terms of credit they offer to a company. A financially stable and well-managed company may receive more favorable credit terms.

-

Regulatory Authorities:

- Compliance Monitoring: Regulatory authorities require companies to submit regular financial reports to ensure compliance with accounting standards and legal requirements. These reports serve as a basis for regulatory oversight and monitoring.

- Investor Protection: Financial reports contribute to investor protection by providing transparent and accurate information. Regulatory bodies use these reports to identify potential financial irregularities and protect investors from fraudulent activities.

-

Employees:

- Job Security and Stability: Employees benefit from accounting reports indirectly. A financially stable company is more likely to provide job security, salary increases, and benefits. Accounting reports contribute to employees’ confidence in the company’s financial stability.

- Profit-Sharing Programs: In companies with profit-sharing programs, accounting reports are used to calculate and distribute bonuses or incentives to employees based on the company’s financial performance.

-

Customers and Suppliers:

- Supply Chain Relationships: Customers and suppliers may review a company’s financial reports to assess its financial stability. A financially healthy company is more likely to honor its contracts and maintain stable supply chain relationships.

- Credit Terms: Suppliers may use accounting information to determine credit terms offered to a company. A strong financial position may lead to more favorable credit terms, enabling better business relationships.

-

Analysts and Financial Advisors:

- Investment Recommendations: Financial analysts and advisors use accounting reports to analyze companies and provide investment recommendations to clients. They rely on financial statements, ratios, and other accounting data to assess investment opportunities.

- Risk Assessment: Analysts use accounting information to evaluate financial risk factors associated with investing in a particular company. This assessment guides investors in making well-informed decisions.

-

Government and Tax Authorities:

- Tax Compliance: Tax authorities use accounting reports to verify a company’s tax compliance. Financial statements and reports provide essential information for calculating corporate taxes.

- Economic Planning: Government agencies use aggregated financial data from various companies for economic planning and policy-making. Financial reports contribute to the overall understanding of the economic landscape.