Table of Contents

What Is a Balance Sheet?

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It consists of two main sections: assets and liabilities, with equity representing the ownership interest. The balance sheet adheres to the accounting equation:

Assets = Liabilities + Equity.

How Balance Sheets Work

Balance sheets work by presenting a comprehensive overview of a company’s financial position at a specific point in time. The document adheres to the fundamental accounting equation:

Assets = Liabilities + Equity

Here’s how balance sheets work:

-

Assets:

- Current Assets: These are assets expected to be converted into cash or used up within one year. Examples include cash, accounts receivable, and inventory.

- Non-Current Assets: These are long-term assets with a useful life extending beyond one year. Examples include property, plant, equipment, and intangible assets.

-

Liabilities:

- Current Liabilities: These are obligations due within one year, such as accounts payable, short-term debt, and accrued expenses.

- Non-Current Liabilities: These are long-term obligations extending beyond one year, including long-term debt and deferred tax liabilities.

-

Equity:

- Equity represents the residual interest in the company’s assets after deducting liabilities. It includes:

- Common Stock: The amount invested by shareholders through the purchase of common shares.

- Retained Earnings: Accumulated profits or losses that the company has retained over time.

- Additional Paid-in Capital: The amount received from shareholders for shares beyond their face value.

- Equity represents the residual interest in the company’s assets after deducting liabilities. It includes:

The balance sheet follows the accounting equation, ensuring that assets always equal the sum of liabilities and equity. This fundamental principle reflects the idea that a company’s assets are financed by either external obligations (liabilities) or internal ownership interests (equity).

How It Works:

- Snapshot of Financial Position: The balance sheet provides a snapshot of a company’s financial health at a specific moment, typically the end of a reporting period.

- Assets = Liabilities + Equity: This equation must hold true, ensuring the balance sheet is balanced. Any change on one side requires a corresponding change on the other.

- Financial Analysis: Investors and analysts use balance sheets to assess a company’s liquidity, solvency, and overall financial strength.

- Trend Analysis: Comparing balance sheets over different periods helps identify trends and evaluate the company’s financial performance and stability.

- Decision-Making: Stakeholders use balance sheets for decision-making, such as assessing creditworthiness, making investment decisions, or understanding a company’s ability to meet short-term and long-term obligations.

Importance of a Balance Sheet

The balance sheet holds significant importance as a financial statement that provides a detailed overview of a company’s financial position. Its relevance lies in the following key aspects:

1.Financial Health Assessment

The balance sheet is a crucial tool for stakeholders, including investors, creditors, and management, to assess a company’s overall financial health. It offers a comprehensive snapshot of the company’s assets, liabilities, and equity, enabling a holistic evaluation.

2. Liquidity Analysis

By detailing current assets and liabilities, the balance sheet helps assess a company’s short-term liquidity. This information is vital for understanding the company’s ability to meet its immediate financial obligations.

3. Solvency Evaluation

The balance sheet aids in determining a company’s long-term solvency by providing insights into non-current assets and liabilities. It helps stakeholders gauge whether the company has the resources to meet its long-term obligations.

4. Investor Decision-Making

Investors use the balance sheet to make informed decisions about investing in a company. It provides crucial information about the financial structure, assets, and liabilities, helping investors assess the company’s stability and potential for returns.

5. Creditor Risk Assessment

Creditors, such as banks and suppliers, utilize the balance sheet to evaluate the creditworthiness of a company. They analyze the company’s ability to repay loans and meet payment obligations.

6. Strategic Planning

Management relies on the balance sheet for strategic planning and decision-making. It assists in determining capital structure, assessing the need for financing, and making informed choices about investments and expansions.

Limitations of a Balance Sheet

While a balance sheet is a crucial financial statement, it comes with certain limitations that should be considered:

- Historical Cost Basis:

- Assets are recorded at their purchase cost, not reflecting potential changes in market value.

- Intangible Assets Challenges:

- Hard-to-value assets like goodwill may not be fully represented on the balance sheet.

- Subjectivity in Valuation:

- Some values, like depreciation estimates, involve subjective judgments affecting accuracy.

- Omitted Items:

- Important non-tangible assets and future revenue streams are not included.

- Doesn’t Capture Dynamic Nature:

- Snapshot at a specific time; changes post-reporting may not be reflected.

- No Measurement of Future Performance:

- Focuses on past financial position, lacking insights into future performance.

- Complexity in Comparisons:

- Comparing balance sheets across companies can be complex due to varying accounting methods.

- Lack of Information on Operating Efficiency:

- Limited information on how efficiently a company generates profit from its assets.

- Ignoring Non-Financial Factors:

- Non-financial aspects like management changes aren’t considered.

- Not Reflective of Market Conditions:

- External factors’ impact, like economic changes, may not be immediately visible.

Example of a Balance Sheet

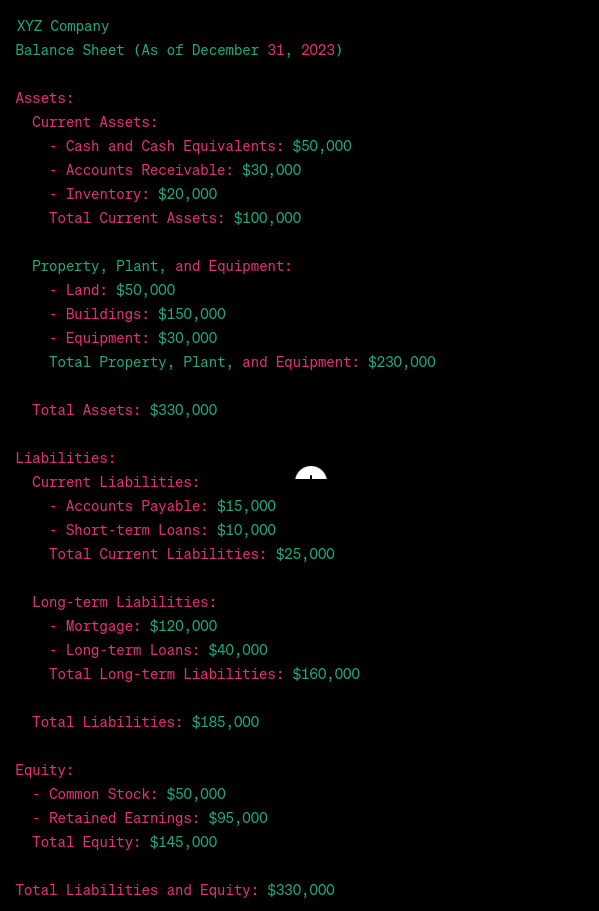

Let’s consider a simplified example of a balance sheet for a fictional company, XYZ Corporation, as of December 31, 2023)

In this example:

- Assets represent what the company owns or is owed.

- Liabilities represent what the company owes to others.

- Equity represents the shareholders’ interest in the company.

The balance sheet follows the accounting equation: Assets = Liabilities + Equity. In this case, $330,000 in assets equals $185,000 in liabilities plus $145,000 in equity, ensuring the balance sheet is balanced.

FAQs

- What is a balance sheet?

- A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It consists of assets, liabilities, and equity, adhering to the accounting equation: Assets = Liabilities + Equity.

- What is the purpose of a balance sheet?

- The balance sheet serves to show the financial health of a company by presenting its assets, liabilities, and equity. It helps stakeholders assess liquidity, solvency, and overall financial stability.

- How often is a balance sheet prepared?

- Balance sheets are typically prepared at the end of an accounting period, such as quarterly or annually, to coincide with financial reporting requirements.

- What are current and non-current assets/liabilities on a balance sheet?

- Current assets/liabilities are expected to be used or settled within one year, while non-current assets/liabilities have a longer-term nature, extending beyond one year.

- How is equity calculated on a balance sheet?

- Equity is calculated by subtracting total liabilities from total assets. It includes components like common stock, retained earnings, and additional paid-in capital.

- What does it mean if a balance sheet is “balanced”?

- A balanced balance sheet means that the total assets equal the sum of total liabilities and equity, adhering to the fundamental accounting equation.

- How is the balance sheet different from the income statement?

- The balance sheet shows a company’s financial position at a specific time, while the income statement reports its financial performance over a period, detailing revenues, expenses, and net income.

- Can a balance sheet reveal a company’s ability to generate profit?

- While the balance sheet provides information about a company’s financial position, it does not directly indicate its ability to generate profit. The income statement is more relevant for assessing profitability.