Understanding and managing cash inflows is a fundamental aspect of financial literacy for individuals and businesses alike. Cash receipts play a crucial role in maintaining financial health, tracking income, and facilitating informed decision-making. In this comprehensive guide, we will delve into the intricacies of cash receipts, exploring their importance, best practices, and how technology is transforming the way we manage and document financial transactions.

Table of Contents

What Are Cash Receipts?

Cash receipts represent the money received by an individual or entity in the form of physical currency, checks, or electronic payments. These transactions encompass various sources, including sales, services rendered, rental income, and more. Effectively managing and documenting cash receipts is vital for accurate financial record-keeping and ensures transparency in financial dealings.

Importance of Proper Cash Receipt Management

1. Financial Clarity and Control

Maintaining a systematic record of cash receipts provides a clear overview of the financial landscape. It enables individuals and businesses to track income sources, identify trends, and make informed decisions to achieve financial goals.

2. Budgeting and Planning

Accurate cash receipt records are instrumental in effective budgeting and financial planning. By understanding the inflow patterns, individuals can allocate resources wisely, plan for expenses, and avoid financial pitfalls.

3. Tax Compliance

Properly managed cash receipts are crucial for tax compliance. Individuals and businesses must report their income accurately to tax authorities. Detailed and organized records simplify the tax filing process and reduce the risk of errors or audits.

4. Business Growth and Investment

For businesses, a clear understanding of cash receipts is essential for strategic decision-making. It helps in identifying profitable ventures, assessing the viability of expansion plans, and attracting potential investors through transparent financial reporting.

Components of a Cash Receipt

A typical cash receipt includes essential information to accurately document a financial transaction. The key components are:

1. Date of Transaction

Recording the date of the cash receipt is essential for chronological tracking and facilitates easy retrieval of transaction records.

2. Payer Information

Clearly stating the name and contact information of the payer ensures that the transaction can be easily identified and verified.

3. Payment Method

Specify whether the payment was made in cash, check, or through electronic means. This information aids in reconciling accounts and understanding the liquidity of received funds.

4. Description of Goods or Services

For businesses, providing a detailed description of the goods or services associated with the cash receipt enhances transparency and helps in categorizing income streams.

5. Amount Received

The core of the cash receipt, the amount received must be clearly stated. This includes the total sum received and a breakdown if applicable (e.g., product cost, taxes, or additional fees).

6. Signature or Confirmation

Having the payer sign the receipt or providing another form of confirmation serves as evidence of the transaction and adds an extra layer of security and authenticity.

Examples of Cash Receipt

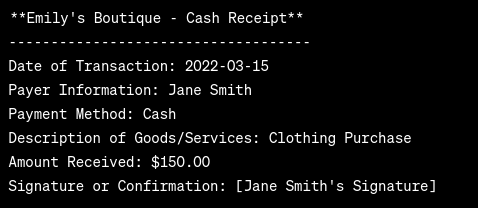

Example 1: Small Business Retail Transaction

Scenario: Emily owns a small boutique and recently made a sale to a customer, Jane, who purchased clothing items totaling $150. Here’s how the cash receipt for this retail transaction might look:

In this example, the cash receipt captures essential details such as the date, payer information, payment method, a brief description of the goods/services, the amount received, and Jane’s signature for confirmation.

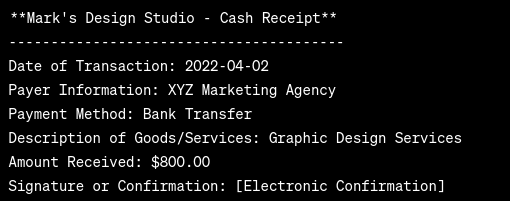

Example 2: Freelancer Service Invoice

Scenario: Mark, a freelance graphic designer, completes a project for a client, XYZ Marketing Agency. The total cost of the project is $800. Here’s how Mark might generate a cash receipt for the payment received:

In this case, the cash receipt includes information on the date, payer (XYZ Marketing Agency), payment method (bank transfer), a description of the services provided, the total amount received, and an electronic confirmation instead of a physical signature.

Benefits of Providing or Obtaining Cash Receipts

Benefits of Providing Cash Receipts:

- Financial Transparency:

- Offering cash receipts enhances transparency by providing a clear record of transactions. This transparency is valuable for both businesses and individuals.

- Proof of Transaction:

- Cash receipts serve as tangible proof of a financial transaction. They document the date, amount, and purpose of the payment, offering a reliable record for future reference.

- Customer Confidence:

- Providing cash receipts to customers instills confidence. It assures them that their payment has been acknowledged and recorded, fostering trust in the business or service.

- Record-Keeping Efficiency:

- For businesses, issuing cash receipts facilitates efficient record-keeping. This organized approach simplifies financial management, making it easier to track income, prepare financial statements, and comply with tax requirements.

- Tax Compliance:

- Properly documented cash receipts contribute to accurate tax reporting. Businesses can use these records to justify income, deductions, and other financial aspects during tax filings.

Benefits of Obtaining Cash Receipts:

- Verification of Payment:

- Individuals or businesses receiving cash receipts have a concrete way to verify that a payment has been made. This helps in reconciling accounts and avoids discrepancies.

- Budgeting and Expense Tracking:

- For individuals, obtaining cash receipts aids in budgeting and tracking expenses. It provides a clear picture of where money is going and supports informed financial decision-making.

- Prevention of Disputes:

- Having a receipt for a payment received minimizes the chances of disputes or misunderstandings. It serves as evidence and can be referenced in case there are questions about the transaction.

- Financial Planning:

- Businesses can use obtained cash receipts for financial planning. Analyzing income patterns helps in forecasting and making informed decisions about investments, expansions, or cost-cutting measures.

- Auditing and Compliance:

- Obtaining and maintaining cash receipts is essential for audits and compliance purposes. It ensures that financial records align with regulatory requirements, safeguarding businesses from legal issues.

Cash Receipts vs. Cash Disbursements

| Cash Receipts | Cash Disbursements |

|---|---|

| Definition Money received by an individual or business in various forms, including cash, checks, or electronic payments. |

Definition Money paid out or disbursed by an individual or business to cover expenses, purchases, or any other financial obligations. |

| Sources Can come from sales, services rendered, rental income, or any other form of income. |

Purposes Includes payments for goods, services, salaries, operating expenses, and any other financial obligations. |

| Documentation Involves creating a record or receipt acknowledging the receipt of funds. |

Record-Keeping Involves documenting and keeping a record of outgoing payments. |

| Examples Payments from customers, rental income, sales revenue. |

Examples Vendor payments, salary disbursements, operating expenses. |