Table of Contents

What is Construction Accounting?

Construction accounting is a specialized branch of accounting that focuses on the financial management and reporting specific to the construction industry. This sector has unique characteristics, project-based revenue recognition, complex cost structures, and distinctive financial challenges, making tailored accounting practices essential. Construction accounting helps companies in the construction industry effectively manage their finances, monitor project costs, and comply with industry-specific regulations.

Key features of construction accounting

-

Job Costing

- Construction projects are often unique and require detailed tracking of costs associated with labor, materials, equipment, subcontractors, and overhead. Job costing is a fundamental aspect of construction accounting, enabling accurate cost allocation to specific projects.

-

Progress Billing

- Construction projects are typically billed in stages based on the completion of specific milestones or percentage of completion. Construction accounting involves creating and managing progress billing systems to ensure accurate and timely invoicing.

-

Revenue Recognition

- Recognizing revenue in the construction industry is often tied to project completion. Construction accountants must adhere to specific methods, such as the percentage-of-completion method or completed-contract method, to appropriately recognize revenue as projects advance.

-

Contract Accounting

- Construction projects involve contracts with clients, and construction accountants must navigate the complexities of contract accounting. This includes ensuring compliance with contract terms, addressing variations, and accounting for any changes in project scope.

-

Cost Controls

- Given the potential for cost overruns in construction projects, construction accounting emphasizes rigorous cost controls. Monitoring and managing costs in real-time help prevent financial surprises and ensure projects remain within budget.

-

Financial Reporting

- Construction accounting generates specialized financial reports, including income statements, balance sheets, and cash flow statements tailored to the unique needs of the construction industry. These reports provide insights into project profitability, financial health, and overall company performance.

-

Compliance with Regulations

- Construction accountants must adhere to industry-specific regulations and standards. This includes compliance with accounting standards like the Construction Industry Accounting (CIA) guide and regulatory requirements related to tax, safety, and environmental concerns.

How to Account for Construction

Similar to various sectors, construction accountants play vital roles in overseeing a company’s financial affairs. Their responsibilities encompass recording transactions, overseeing cash flow, and evaluating profitability. A significant portion of construction accountants’ tasks revolves around meticulously tracking individual projects, which constitute the majority of contractors’ work portfolios. Through the practice of job costing, these professionals facilitate businesses in estimating and scrutinizing costs and revenues for each project, ensuring projects stay on course and remain financially viable.

Construction Accounting vs. Regular Accounting: What’s the Difference?

Here are the key distinctions between construction accounting and regular accounting:

1. Job Costing

- Construction Accounting: In construction accounting, job costing is fundamental. Costs are allocated to specific projects, including labor, materials, equipment, and overhead. This detailed tracking is crucial for monitoring project profitability.

- Regular Accounting: In general accounting, job costing may not be as detailed or project-specific. Businesses in other industries may not have the same need for tracking costs at the granular level of individual projects.

2. Revenue Recognition

- Construction Accounting: Revenue recognition in construction is often tied to project completion. Methods like the percentage-of-completion or completed-contract methods are common, reflecting the unique challenges of recognizing revenue in a project-based industry.

- Regular Accounting: Revenue recognition in regular accounting is typically more straightforward and may follow accrual or cash accounting methods based on the nature of the business.

3. Progress Billing

- Construction Accounting: Construction projects are often billed progressively based on milestones. Progress billing is a standard practice to ensure steady cash flow throughout the project.

- Regular Accounting: In regular accounting, billing may occur based on regular intervals or specific terms outlined in service contracts.

4. Retention Accounting

- Construction Accounting: Retention amounts, withheld until project completion, are common in construction contracts. Construction accounting includes managing and accounting for these retentions.

- Regular Accounting: Retention accounting is specific to industries like construction and may not be applicable in regular accounting scenarios.

5. Work-in-Progress (WIP) Accounting

- Construction Accounting: Tracking work in progress is crucial in construction accounting to assess the financial status of ongoing projects accurately.

- Regular Accounting: Work-in-progress accounting is less prominent in regular accounting, where inventory or production processes may be the focus.

6. Complex Contracts

- Construction Accounting: Construction projects often involve complex contracts, variations, and change orders. Construction accountants need to navigate these intricacies.

- Regular Accounting: Contracts in other industries may be less complex, with services or products delivered based on simpler terms.

7. Industry-Specific Regulations

- Construction Accounting: The construction industry has industry-specific accounting standards and regulations. Compliance with these standards, like the Construction Industry Accounting (CIA) guide, is essential.

- Regular Accounting: Other industries follow general accounting principles applicable to a broader range of businesses.

8. Equipment Depreciation

- Construction Accounting: Construction businesses heavily rely on equipment. Depreciation of construction equipment is a crucial aspect of construction accounting.

- Regular Accounting: Depreciation of equipment may be relevant in other industries, but the types of assets and depreciation methods can vary.

Construction Accounting vs. Regular Accounting

| Aspect | Construction Accounting | Regular Accounting |

|---|---|---|

| Job Costing | Detailed tracking of project costs (labor, materials, etc.) | May not be as project-specific in tracking costs |

| Revenue Recognition | Tied to project completion, percentage-of-completion method | Follows accrual or cash methods based on business nature |

| Progress Billing | Billing based on project milestones | Billing at regular intervals or contract terms |

| Retention Accounting | Management and accounting for retention amounts | Not common, specific to certain industries like construction |

| WIP Accounting | Crucial for assessing ongoing project financial status | Less prominent, focus on inventory or production processes |

| Complex Contracts | Dealing with complex construction contracts, variations | Contracts may be less complex, with simpler terms |

| Industry-Specific Regulations | Compliance with industry-specific standards (CIA guide) | Follows general accounting principles |

| Equipment Depreciation | Crucial for construction equipment | May be relevant, but types and methods can vary |

Financial Statements Specific to Construction Accounting

. The primary financial statements specific to construction accounting include:

-

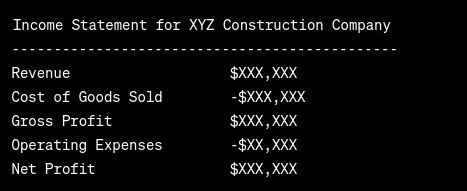

Income Statement for Construction Companies:

- Purpose: To show the profitability of construction projects.

- Key Elements:

- Revenue: Represents income generated from completed projects or recognized based on project milestones.

- Cost of Goods Sold (COGS): Includes direct costs like labor, materials, and subcontractor expenses.

- Gross Profit: Calculated as revenue minus COGS.

- Operating Expenses: Includes overhead costs like administrative expenses, utilities, and insurance.

- Net Profit/Loss: Calculated as gross profit minus operating expenses.

-

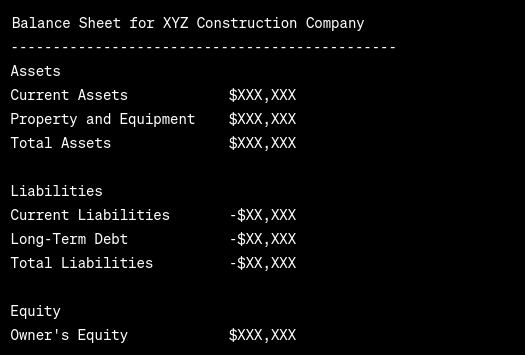

Balance Sheet for Construction Companies

- Purpose: To show the financial position of the construction company at a specific point in time.

- Key Elements:

- Assets: Includes current assets (e.g., cash, accounts receivable) and long-term assets (e.g., property, equipment).

- Liabilities: Includes current liabilities (e.g., accounts payable, short-term debt) and long-term liabilities (e.g., long-term debt).

- Equity: Represents the owner’s or shareholders’ interest in the company.

-

Cash Flow Statement for Construction Companies

- Purpose: To show the inflow and outflow of cash from operating, investing, and financing activities.

- Key Elements:

- Operating Activities: Includes cash receipts and payments related to project costs, subcontractor payments, and other operational expenses.

- Investing Activities: Reflects cash flows related to property, equipment purchases, and other investments.

- Financing Activities: Shows cash flows from debt financing, equity transactions, and other financing activities.

-

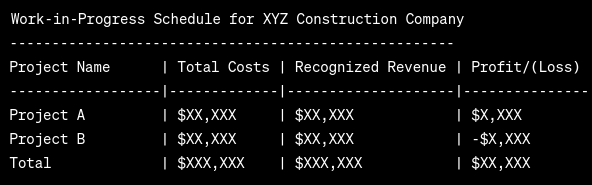

Work-in-Progress (WIP) Schedule

- Purpose: To track the financial status of ongoing projects.

- Key Elements:

- Work-in-Progress: Shows the total costs incurred on projects in progress.

- Recognized Revenue: Reflects the revenue recognized for work completed on projects.

- Profit/(Loss): Calculated as recognized revenue minus total costs.